Prepping isn’t cheap. You already know that stockpiling extra food on top of your monthly grocery list, getting special gear for your EDC and BOB, buying weapons and making sure your property is secure are additional expenses that can put serious strain on your pocket.

Any good prepper knows that money savviness is a vital skill to develop, frugal living is or should be a core skill of every prepper in a world that seems to be spending way more than it should.

You can save money by changing your spending habits little by little.

Small adjustments to your daily expenditure can make a big difference to your overall financial health and leave more funds available for investing in more urgent commitments, such as prepping.

Using Food and Other Preps to Augment Your Finances

It is an easy trap to fall into thinking you only need a big ol’ fat stack of cash and nothing else to survive an economic collapse.

Collating the second and third order effects that will result from an economic collapse is extremely difficult because they will be so widespread and so varied.

One thing people don’t count on is the rising price of goods due to shortages.

Think about it: All of those jobs that went bust and didn’t come back mean that fewer people are going to have the same amount of money they had before.

If they don’t have the money to spend on goods, even true necessities like food, they won’t be buying them.

If they aren’t buying them, the companies that make, ship them and sell them will not be buying, shipping and selling as much.

If there is not as much stuff to go around because manufacturers are out of business, demand has shrunk and so on it stands to reason that there is likely to be shortages on those goods in the aftermath.

If there was a shortage on goods, that means that prices will go up due to scarcity. If prices go up, you really don’t have as much money as you think if you still need to buy those necessities.

The solution to this is to have a ready store of food and all kinds of household goods just like you have cash on hand.

Aside from being a massive comfort since you’ll be able to draw on your own supplies and not be held hostage by the whims of the market, this will augment your savings since you won’t be spending it on those selfsame supplies once you have lost your primary income source.

Your family will doubtlessly appreciate this since their concerning meal times and their general household environment won’t really change at all while everyone else is suffering or does without entirely.

You will also be able to use these items as bargaining chips for people that need them. There is a very real chance they can become currency for other goods, or for favors from other people.

Building a Nest Egg Worthy of a Prepper

A nest egg for normal, unconcerned people, and a nest egg for a prepper don’t look exactly alike.

Both require money, of course, but a nest egg for a prepper also includes survival necessities, with those necessities being clean water, a good supply of food that can feed your family, household staples, and other small but necessary items that make civilized life worth living.

I will assume that most of my readers and the readers of this site have plenty of those goods in abundance even if they don’t have a substantial amount of money saved. We will fix that.

Saving money is not a big deal. In fact, it is really simple. But as we have all learned painfully before just because something is simple does not mean it is easy to do.

Saving correctly means you put back a fraction of everything you earn, any which way you earn it, into a dedicated, untouchable fund or savings account.

The savings account could take many forms, from a simple home safe or strong box to the traditional institutional savings account at your local bank. Both have their advantages and disadvantages.

Cut Down on the Little Things

- Prepare your work lunch at home and pack it in a Tupperware. This way, you’ll be less tempted by overpriced cafeteria food and bakery goods.

- Eat before you head to the grocery store. You’d be surprised how much money you can waste on filling your trolley with snacks when you shop on an empty stomach.

- Quit smoking. Now. It’s an expensive, unhealthy habit that will set you back financially and put your health at risk. By giving up your daily pack, you can save enough to purchase more food for your stockpile or survival items for your BOB.

- Stock up your fridge with groceries, so that you won’t be tempted to order in.

- Make a habit of making coffee at home and taking it with you in a thermal flask. Your daily Starbucks adds up to around $4.50 per day. Think about how much you can save if you stick to the old French press.

- Avoid buying things in installments. Interest rates are often exorbitant and you’ll end up paying back much more than the product is worth.

- Have a yard sale and sell off your old stuff. You may have outdated gear lying around. Sell it to recover the initial costs and use your proceeds to purchase new, improved gadgets.

- The lottery is a pipe dream. You’re more likely to be struck by lightning that to strike the jackpot. Instead of wasting money on odds that will always be against you, invest your cash in supplies. Besides, when SHTF it won’t matter how much money you have.

- Cancel your cable subscription. Most people only watch about 17 programs regularly: why pay for the rest?

- Don’t become a fashion victim. Buy quality clothing instead of branded apparel.

- If your clothing is worn or needs some TLC, have it repair by a tailor instead of disposing of it and buying new stuff.

- Order online. Most online stores offer free shipping in the US. Plus, you’ll save yourself the expensive, time-consuming hassle of shopping at a mall. It’s best to view the item in-store before buying it online.

- When shopping, use comparison sites like pricegrabber.com to find the best prices on gear and gadgets.

- Reduce your phone bill by using Skype or Google Voice. Most people already have an account and you can make calls to anywhere in the world using the app. Keep your landline active, though, in case you need to make emergency calls during a crisis.

- Stick to plastic. ATM withdrawals carry hefty fees, making card payments a much cheaper option. But remember to keep cash in a safe hiding place at all times, because cards will be instantly useless when SHTF.

- Never pay full price for clothing. Shop at outlets and factory stores, or wait for the sales to grab amazing bargains.

- Get a prepaid phone. Contracts seem attractive, but they’re designed to rope you in. You can save a couple of hundred dollars a year by staying away from them.

- Get WhatsApp and Telegram, low-cost ways of staying in touch with friends and family, especially when traveling abroad.

- Stay home. Instead of heading out to the bar for beers with your friends, invite them to your home. You can buy supplies at the local supermarket for the fraction of the price. If you do go out for the occasional drink, stick to happy hour.

- One evening at a nice restaurant can cost you the equivalent of a week’s worth of groceries, so try not to frequent them. Unless it’s special occasion.

- Coupons are your friends. You can score plenty of fresh fruit and vegetables, meats and fish for as little as $200 a month for two people if you use your coupons smartly.

- Walk or cycle whenever you can, because gas and bus tickets add up.

- Use less toothpaste and shampoo. Don’t be fooled by those commercials where they pour copious amounts of their product, you don’t need nearly that much. The trick to staying cavity-free is in how you brush, not in the amount of toothpaste you use.

Swap, Barter, Exchange

- Use your network. If you have a neighbor who farms organic beef, for example, he may give you a special price on meat cuts.

- Take turns babysitting, housesitting or pet sitting. Hiring these services can be pricey. It’s much cheaper to swap sitting duty with fellow parents or pet owners so you can enjoy peace of mind without spending a dime.

- Host a clothing swap with your friends and family. Most people have a bunch of perfectly good clothes they never wear and may be a great fit on you.

- If you live on a rented property or in an RV, offer to do odd jobs for your landlord in exchange for a lower rental.

- Get to know reps from weapon or ammo companies for access to great discounts.

Go Big

- Keep a lookout for bulk deals at supermarkets. Larger quantities often qualify for great discounts and you can store half of it in your food stockpile, if it’s non-perishable.

- Discount and bulk-buying websites like Groupon are also good options for deals on goods and services.

- When cooking, try whipping up large batches and freezing the leftovers.

Use Your Assets

- Upskill yourself. Learn to bake and cook from scratch, rather than buying store-bought foods such as waffles, tortillas, frozen pizzas and pies. Home cooking is cheaper and far healthier.

- Read widely. Self-improvement and personal finance books will set you on the right path for a healthy financial future. Soon, saving will become second nature!

- Start exploring a supplementary income. You can devote time into doing a hobby you enjoy while making money on the side. Flex those entrepreneurial muscles by selling homemade products on Etsy or writing freelance pieces for magazines.

Around the House

- Make your own laundry soap and dishwasher detergent by the gallon. You’ll need inexpensive soap bars, water, washing soda and borax.

- Vinegar also makes a powerful cleaning agent. Add it to short cycle washes or use it to clean around the house. It’s a natural, less expensive way to do chores.

- Hand wash your dishes instead of using a dishwasher.

- Turn off the anti-sweat feature on your fridge to save 5-10% of its electricity consumption.

- Turn the heating down on winter nights to 58-60F and switch off the air conditioner on summer nights.

- Upgrade your light bulbs to the soft-glow energy-efficient kind. You can save $50 a year with this simple trick.

- Use a canister vacuum instead of one that contains bags.

- Reduce your household’s energy consumption by switching off all non-essential appliances, installing a geyser timer and turning off lights when you leave the room.

- Wash your car yourself. All you need is a vacuum, some leather conditioner and a bottle of wax.

- Hang your clothes out to dry in the sun, rather than use power-chewing tumble dryers.

- Homeschooling saves a huge amount on fees. The Internet is teeming with great resources on school subjects for all grades.

- Install a water-flow regulator in your shower head for instant savings. They cost between 10$ and 20$ and will slash up to 60% of your water bill.

Kitchen Tricks

- Extend the shelf life of your vegetables by lining your fridge’s crisper draw with paper towels to absorb moisture and delay rot.

- Slip a bay leaf into your flour, rice and pasta stores to keep weevils away.

- Keep your bananas in bunches until you need them. They’ll stay riper for longer.

- If your honey starts to crystallize, simply microwave it at medium heat for 30 second bursts until it clears.

- Brown sugar kept in the freezer does not harden; but if your sugar has already hardened, microwave it on high for 30 seconds.

- If carrots, celery or radishes have gone limp, you can get their crunch back by popping them into a bowl of iced water along with a slice of raw potato. Magic!

- You can tell if an egg is fresh by how it behaves in water. Good eggs sink, bad ones float.

- Plant fruit trees and make a habit of canning fresh produce.

- You can keep your herbs for longer by simply storing them in sealed Ziploc bags in the freezer. They’ll be easier to chop and will defrost as soon as you throw them in the pan.

- Raise your heirloom vegetables in seed trays stored on a shelving unit. This is a far more cost-effective option than building a greenhouse.

The Power of Negotiation

- Work up the guts to ask for a raise at work. Not only do you deserve it, but you’ll have more savings to put away thanks to your sharpened negotiation skills.

- Before you sign a rental lease, ask the landlord if there is a discount if you pay early each month. There’s no harm in asking and you’ll be surprised how many landlords agree to a monthly discount or a break from rental increases.

Money Magic

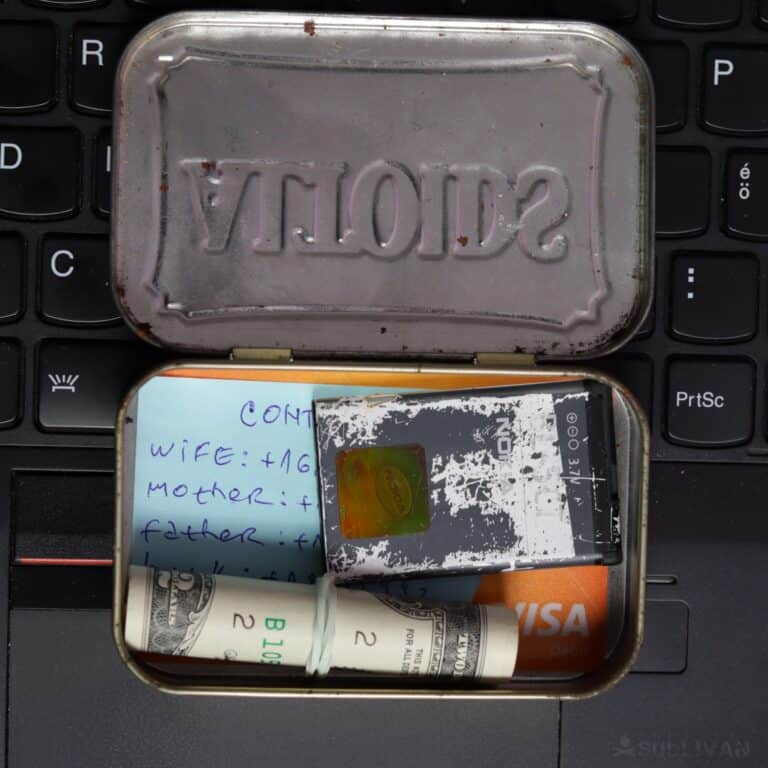

- Save all your $1 bills in a safe cache. You’ll be amazed at how much it adds up to each year. You can accumulate several thousand dollars if you do it consistently.

- Automate your bank account so that a portion of your paycheck is immediately transferred into your savings account. You’ll force yourself to save and live within your means.

- Stay on top of your insurance expenses. You’ll be surprised at how much money you can save by doing your research and shopping around for the most competitive premiums. Break everything down, customize your plan according to your unique needs and watch the savings grow.

- Plan your train and bus trips in advance and enjoy discounts of up to 80% on your fares.

- If you pay your state taxes early, you’ll be rewarded with a 10% discount. On the flipside, don’t be late with your payments, or you’ll receive a penalty fee of 2% per month.

Use the Three Pocket Rule: Pocket A contains your total monthly income from various work activities. Pocket B is your daily spending allowance.

Take the amount in Pocket A and divide it by the number of days in the current month. If, on the final day of the month, you haven’t spent all of Pocket B, the difference will constitute Pocket C.

These are your savings. You will use these to cover unforeseen expenses or in the event of an emergency. I recommend you store Pocket C in cash, if possible.

Observe and Listen

Pay attention to what is happening around you. You’ll be surprised at some of the things you can pick up by watching and listening.

Maybe you overhear someone is taking an old tub to the landfill, offer to take it off their hands, it will make a great grow bed or even a small duck pond, or you might hear someone is tearing down an old shed or deck, this is the lumber you need for your grow beds.

You can pick up on many things by listening, observing and engaging, and, more recently, by reading and watching the sheer amount of content you find online.

Stop Buying So many Things

Control the things you buy. Ask yourself first if you really need it and then how can you repurpose it. The current propensity for humans to consume is unsustainable and created by greed.

Before each purchase, ask yourself several times whether you really need it. Let some time pass before you buy it. Visualize yourself using it, and only buy it if the usage scenarios are truly useful and/or cannot be accomplished with the things you already have.

Opting Out of Economic Dependency with Homesteading

There is one more thing you could do to help insulate you and your family from a serious economic depression, and that is go off-grid. And I mean truly off-grid.

Going off-grid is seen as something of a crown jewel in prepping, the summit that one hopes to achieve one day once you are good enough, experienced enough and financially stable enough to afford the transition.

With a homestead of your own, the right equipment, enough land and the right know-how you can provide pretty much everything you need to survive and also many modern conveniences, including electricity and running water.

People have been doing it pretty much forever, raising animals for their meat, eggs and milk.

Growing fruits, vegetables and grains and generally being self-reliant, or at least self-reliant in the context of a small community of people who are genuinely interested in each other’s success and survival.

The more you can provide for yourself through your own labors the less you need other people for, and the less money you need to buy the things you need from other people. This is not a pipe dream, and it is not fantasy

You probably cannot ever truly get completely away from society, not in this era, unless you went to genuinely live like a hermit.

Otherwise, the tax man will always be after you for one thing or another, and will stop at nothing to find you, but you can get rid of your dependency on city utilities, city conveniences and all the rest of it.

My dad was military. My grandfather was a cop. They served their country well. But I don’t like taking orders. I’m taking matters into my own hands so I’m not just preparing, I’m going to a friggin’ war to provide you the best of the best survival and preparedness content out there.

Glad to see I’m not the only one who follows these guidelines. Big Guy and I team up to get them all accomplished. Thanks for a list that makes us look good.